WHAT ARE THE TYPICAL PROPERTY PRICES FOR FLATS IN THE UK?

In London, a 1-bed flat ranges from £300,000 - £600,000, and it could be even more in prime areas such as the West End. In other cities such as Manchester and Liverpool, you can get a 1-bed flat from £100,000. The prices vary greatly depending on the location, quality of developments and its amenities.

WHAT IS A TYPICAL LAND TENURE OF UK PROPERTIES?

The vast majority of flats in England and Wales are leasehold. This includes everything from new-build properties, converted houses, and 1960's tower blocks to Victorian flats. When you purchase a leasehold property, what you are buying is a legal right (a lease) which gives you effective ownership of the property for a given period of time, i.e. the duration of the lease. Common leasehold interests are granted for 99, 125, 250 and 999 years.

CAN FOREIGNERS OWN UK PROPERTIES UNDER THEIR OWN NAME?

Yes, UK properties can be fully owned by foreigners under their own name and there are no buying restrictions for foreigners.

DO I HAVE TO GO TO THE UK IN ORDER TO PURCHASE THE PROPERTY?

No, you do not need to go to the UK in order to purchase the property. Signing documents for the purchase can be done outside of the UK. Our company will make arrangements for your best hassle free experience.

WHICH PART OF UK SHOULD I INVEST IN?

Prime Central London (ie: West End) would be a good location for capital preservation. Prime Central London is still seen as a ‘safe haven’. Low interest rates and political/economic uncertainty are driving funds into London property as it is seen as a good asset in uncertain economic times. However the fringe of London (ie. Docklands), and second tier cities such as Manchester and Liverpool would be more suitable for investors looking for capital growth and higher rental income.

HOW DO I CHOOSE THE RIGHT LOCATION?

There are different strategies in choosing the right location for different cities. In London, the strategy is to choose properties that are close to tube or future cross-rail stations. In tier 2 cities such as Manchester, you should choose properties which are close to central business district, as central location gives you the highest occupancy rate. Please speak to our sales representatives to learn more about the different strategies and options available to you.

WHAT IS THE CURRENT RENTAL YIELD ON UK PROPERTIES?

Different cities in the UK offer different rental yield to investors. In London the rental yield ranges from 2% p.a. (prime central London) to 5% p.a. (fringe of London). In places such as Manchester and Liverpool you can easily get up to 7.5% - 8.0% p.a. rental yield.

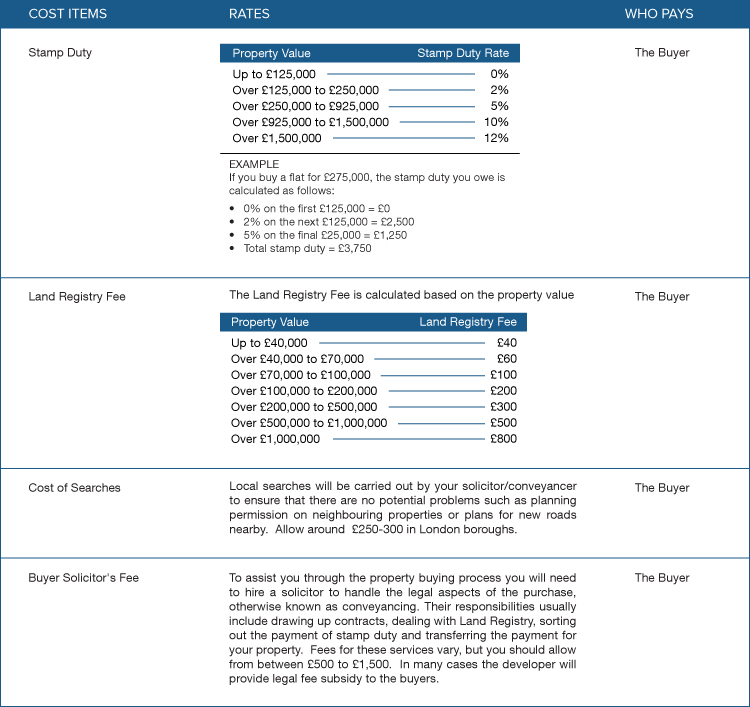

WHAT ARE THE UPFRONT BUYING COSTS FOR UK PROPERTY?

The upfront buying costs for UK flats are typically:

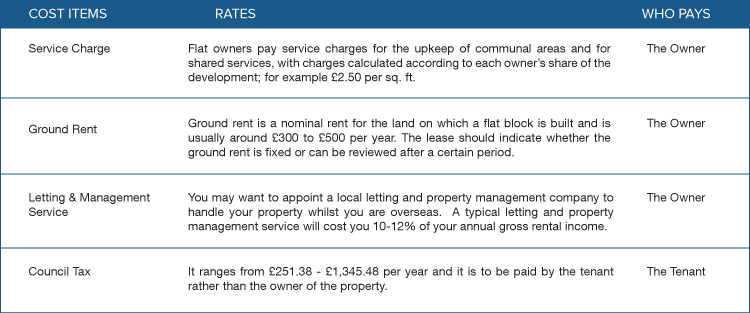

WHAT ARE THE RUNNING COSTS FOR UK PROPERTY?

The running costs for UK flats are typically:

WHAT ARE THE TAXES FOR UK PROPERTY?

There are typically 2 types of taxes to be paid by the property owner:

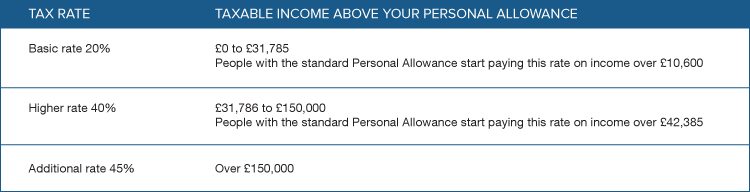

1. Rental Income Tax*

Rental income generated from your property is subject to personal income tax. The standard Personal Allowance is £10,600, which is the amount of income you don't have to pay tax on. For example, if you purchased a property worth £200,000 and are receiving gross rental income of 5% p.a. (£200,000 * 5% = £10,000), you do not have to pay any income tax, assuming this is the only income source you have in the UK.

Example:

You have £35,000 of taxable income and you get the standard Personal Allowance of £10,600. You pay basic rate tax at 20% on £24,400 (£35,000 minus £10,600).

Tax Deductions:

Property owners can deduct allowable expenses to work out their taxable income. The most common types of expenses you can deduct are:

- water rates, council tax, gas and electricity

- maintenance and repairs to the property (but not improvements)

- contents insurance

- interest on a mortgage to buy the property

- costs of services, including the wages of gardeners and cleaners (as part of the rental agreement)

- letting agents' fees

- legal fees for lets of a year or less, or for renewing a lease of less than 50 years

- accountant’s fees

- rents, ground rents and service charges

- direct costs such as phone calls, stationery and advertising for new tenants

2. Capital Gain Tax*

From April 2015, non-UK residents selling UK residential property will be subject to capital gain tax of 18% (basic rate) or 28% (higher rate).

*The information gathered here is general in nature, incomplete, and may not apply to your specific situation. You should consult your own tax advisor regarding your tax needs. Golden Emperor Properties makes no warranties and is not responsible for your use of this information or for any errors or inaccuracies resulting from your use.

WHY SHOULD I INVEST IN UK PROPERTY NOW?

London is considered the most desired location in the world to buy property; it offers a transparent government and political stability, allowing our foreign clients to make a safe investment. It offers world class education, shopping and restaurants, is the worldwide HQ for business, and still remains the financial capital of UK.

The UK has historically always been an area that people have invested in from around the world. Foreign Investors are increasing their grip on the capitals prime property where residential prices have always risen - even being recession–proof throughout the crises. Investment is now moving from central London through to areas of greater London and other major cities such as Manchester, Liverpool and Leeds as investors can receive excellent capital growth with a high rental return which becomes a self–sufficient investment.

Investment in the UK has increased year-on-year due to supply and demand. Over the next 20 years UK households are expected to increase by up to 40% placing on an even greater demand on available housing. The UK government estimates that 240,000 new properties need to be built in England every year just to keep pace with demand and as building of new homes is at an all time low since 1920’s. Investing in UK property couldn’t be made at a better time.

Contact us as soon as possible if you have an interest. We have a team of specialists including UK solicitors to assist you throughout the entire process.